Options Road Trader Documentation

Welcome to options trading automation technology. All you need to do is to link Options Road to your Interactive Broker account and build your custom options strategies or choose a template to customize. You can automate repetitive trading tasks so you can focus on higher-level strategy optimization to scale your portfolio.Configuration and Setup

Options Road Setup

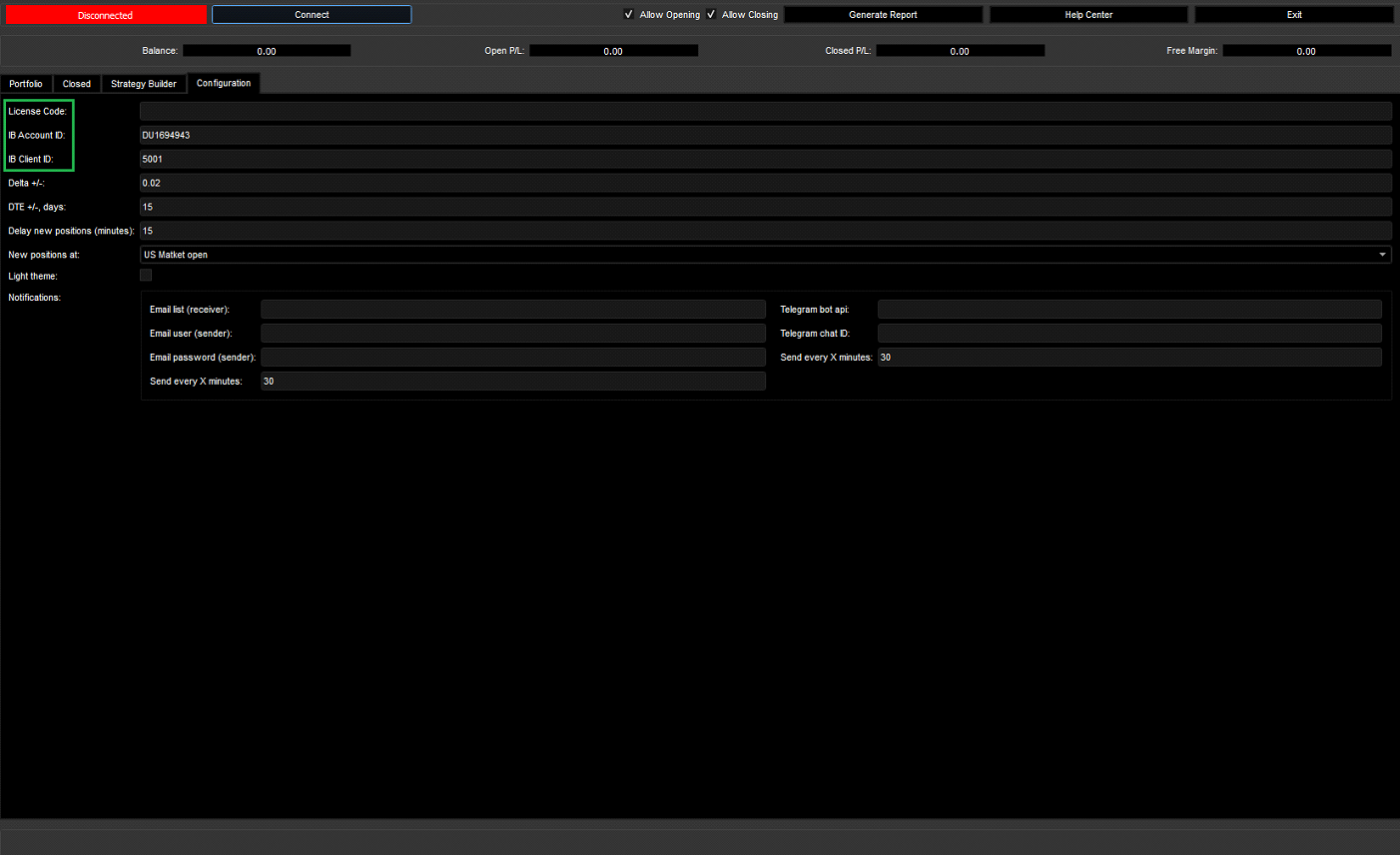

In order to use the application, it must be connected to an Interactive Brokers account and have a valid license. The configuration tab provides global settings for the application as well as options for connectivity and notification setup.Begin first by adding the license code received from your purchase on optionsroad.com into the “License Code” field in the configuration tab.

From Interactive Brokers copy the account ID found in the top right of their interface and paste it into the “IB Account ID” field. Make sure the “IB Client ID” field is “5001”.

Interactive Brokers TWS Setup

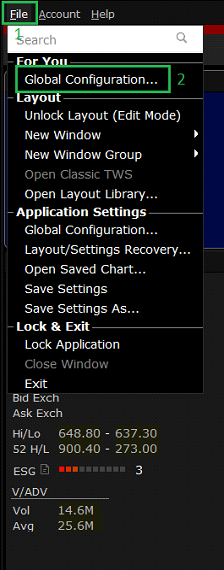

To setup Interactive Brokers TWS so it can communicate with Options Road follow the following steps:- In the IB interface open the “file” menu found in the top left of the application.

- Select “Global Configuration” from the drop-down menu.

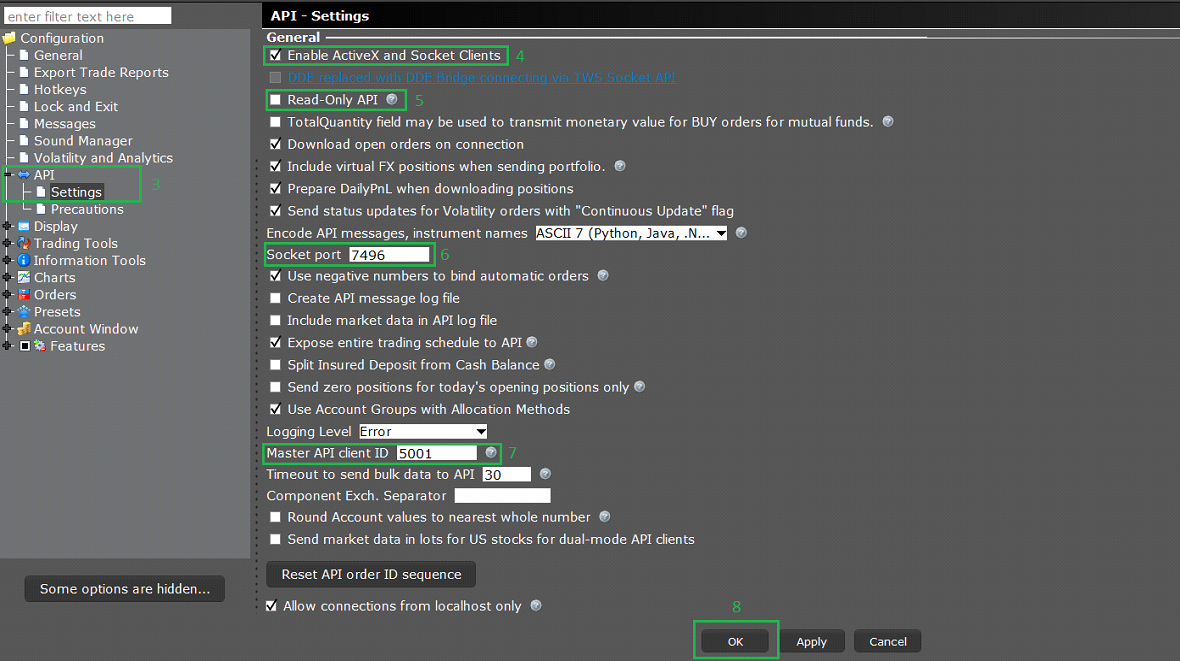

- Select “API” in the left side of the configurations screen then select “Settings” under the API.

- Ensure the “Enable ActiveX and Socket Clients” box is ticked (first box).

- Untick “Read Only API” (third box).

- Set the “Socket Port” to 7496.

- Set the “Master API client ID” to 5001.

- Click “Ok” in the bottom of the screen to close it and apply the changes.

Global Settings

- Adjust “Delta +/-“ field according to the maximum variation in delta when opening a new position. For example, if a leg has a delta of 0.05, a setting of +/- 0.01 would allow the range of 0.04-0.06 for that leg.

- Adjust “DTE +/-“ field according to the maximum variation of days when opening a new position. For example, if a leg has a DTE of 14 days, a setting of +/- 4 would allow a DTE of 10-18 for that leg.

- To delay the opening of new positions, enter the number of minutes to delay by in the “Delay new positions (minutes)” field.

- In the “new positions at” field choose whether the delay added in the previous step is after the exchange opens or the US market opens.

Notifications

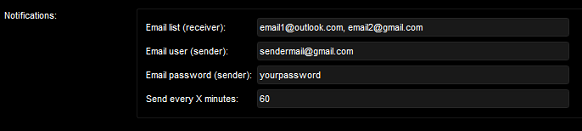

To receive email notifications from the Options Road application which include open positions and P/L follow the following steps:- In the “email list (receiver)” field add any number of emails to receive the notifications (comma-separated).

- In the “Email user (sender)” field add the email that the notification will be sent from. This can be a new and empty email account for this purpose alone.

- In the “Email password (sender)” field add the password of the sender email created in the previous step.

Application Overview

This section provides an overview of all the main fields and tabs in Options Road along with their functionality.Header

On the left side of the header is the connection panel. The first field shows the current connection status. If Options Road is connected to the broker, it will show “connected” and show “disconnected” if the connection has been lost of not yet established. Similarly, it will show “connecting” when trying to establish a connection with the brokerage platform.On the right side of the header are the following fields in order from left to right:

- “Allow Opening”: if ticked this will globally allow new positions to be opened, if unticked no new positions can be opened by any strategy. However, all positions will continue to be managed by Options Road.

- “Allow Closing”: if ticked this will globally allow existing positions to be closed, if unticked no positions can be closed by any strategy. However, new positions will continually open.

- “Generate Report”: This generates a report with the closed positions, strategy performance and balance as an output file.

- “Help Center”: Redirects to the Options Road website for customer support and FAQs.

- “Exit”: Simply exits the application.

Balance Overview

Under the header there are four fields to relay information about performance and the status of your brokerage account.- “Balance” shows the current balance. Added to it are any premiums collected from credit positions. Subtracted from it are any premiums paid from debt positions.

- “Open P/L” and “Closed P/L” show the P/L of currently open and closed positions, respectively.

- “Free margin” shows the amount of margin remaining in your account to open new positions with.

Status Bar

The status bar appears at the bottom of the application and shows what Options Road is currently working on. It is split into two sides. The left side shows any positions being currently opened along with their strategy name and time. The right side shows any positions being closed currently along with their strategy name and time.

Portfolio Tab

All currently open positions are shown in this tab along with all their relevant information. Categorised as follows in order from left to right:- “ID”: Unique ID for each position, no two positions share the same ID.

- “Strategy”: Name of the strategy the position is based on.

- “Underlying”: Name of the underlying that the position is based on.

- “Position size”: The number of combos open in this position.

- “Open Date”: Date position was opened.

- “Open Time”: Time position was opened.

- “Strikes”: Shows the strikes of all legs in the position.

- “Deltas”: Shows the deltas of all legs in the position.

- “Expiry”: Date the legs expire.

- “Premium”: Premium paid or received from this position, if positive then premium was paid for this position. If negative, then premium was collected for this position.

- “Price”: Current price of the contracts.

- “P/L $”: The current P/L of the position in absolute value.

- “P/L %”: The current P/L of the position in percentage value.

- “Status”: Current status of the position. e.g “filled”, “placed”, “filled TP”.

- “Reentry SL/TP”: The first number shows the number of times this position will reenter if it hits the stop loss. The second number shows the number of times this position will reenter if it hits the take profit.

- “Reentry Ref”: If this position is a reentry after a SL or TP shows the ID of the original position, otherwise shows “none”.

- “Close”: Button to manually close a position.

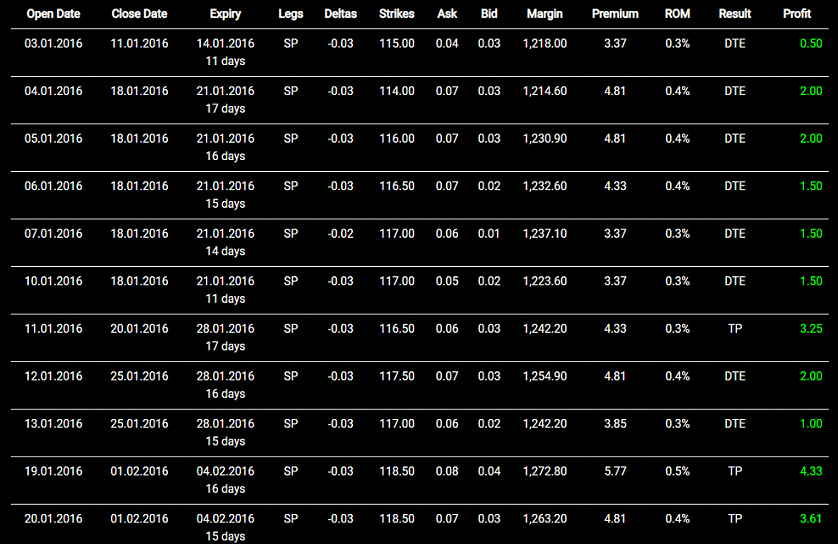

Closed Tab

All closed positions are shown in this tab similarly to the portfolio tab. The majority of the fields are the same as the portfolio tab. Please refer to that for most of the information. The unique fields are categorised below in order from left to right:- “Close Reason”: This is the reason the position was closed. e.g “MSL”, “expired”.

- “Close Date”: Shows the date and time the position was closed.

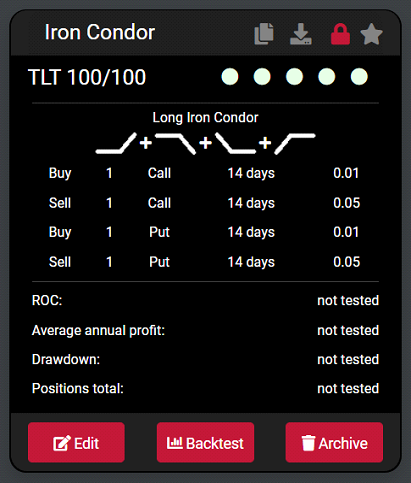

Strategy Builder Tab

This tab is where new strategies are made and added to trading. Options Road allows a large selection of options strategies to be custom made and managed by the application. The strategy builder is split into three sections, the strategy list on the left, the builder itself in the middle and the running strategies on the right side.

The Strategy List

Here all the created and saved strategies are listed in alphabetical order. In order to view or edit a strategy it is selected from this list on the left side of the strategy builder tab. At the bottom of the list there are 3 buttons as follows:- “Add to trading”: Adds the selected strategy to the running strategy list on the right side of the builder. If not on hold new positions will be opened using the strategy and managed by Options Road.

- “Delete”: Deletes the selected strategy.

- “Upload”: This option uploads the selected strategy to the Options Road community website so it can be downloaded later by the user or shared to other users.

The Builder

This is the heart of Options Road and allows options strategies to be created and deployed. This section will run down all the available settings with examples from the top to the bottom:- “Strategy Name”: Enter a suitable name for your strategy here. It is advisable to use a short, descriptive name here.

- “Underlying”: Select the underlying ETF/equity/future your strategy will work on.

- “Trading Frequency (weeks)”: This setting determines how many weeks to pause between opening new positions using this strategy. For example, setting it to 2 would open a position using this strategy for the first week, skip the second week, then open positions again the third week. Each additional week adds an extra week to skip.

- “Place trade day”: Check the days you wish this strategy to open new positions on, new positions will only be opened on the selected days.

- “Position size”: This setting multiplies opened positions by this number. For example, a naked put strategy with a single sold put with “position size” set to 3 would sell 3 put contracts.

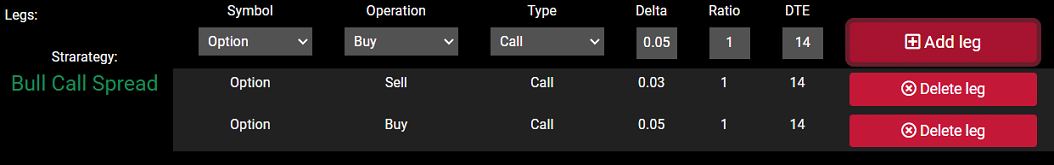

- “Legs”: This section is where you can select which legs to buy or sell as calls or puts. Any combination of legs can be chosen for your preferred strategy. The first column concerns calls, and the second column concerns puts. It comprises 3 components per leg as follows:

- “Delta”: This is your chosen delta for this particular leg. Options Road will open new positions with this delta for the leg within the delta range set in the configuration tab.

- “Ratio”: This is the number of contracts you wish to open of this particular leg. For example, a strategy selling 2 calls and buying 1 call would have a ratio of 1 buy call and 2 sell call.

- “DTE”: The number of days till expiry of this particular leg. A leg with a DTE of 14 would expire in 14 days within the range set in the configuration tab. (Note that if the strategy contains 2 or more legs with identical DTEs then Options Road will ensure they have the same expiry when opening a position. For example, a strategy with 2 legs both with DTE of 14 might both have an actual expiry 16 days after opening due to the allowed range of DTEs in the global settings.)

- “Implied Volatility (IMV)”: You may select the minimum and maximum IMVs to open new positions during here. If the IMV for the underlying is outside the range set here a new position will not be opened. IMV is calculated in percentage. So, a minimum of 0 and maximum of 100 would only open positions if the IMV is above 0% and under 100%. (Note: This works only with the following underlyings: SPX, SPY, ES, MES)

- “Combo Order Direction”: This sets the overall direction for a combo order comprising multiple legs. If the direction is set to sell the legs that are bought will be sold and vice versa. (Note this only works with combo orders and not with single leg strategies).

- “Stop Loss and Take Profit”: This section is for setting stop losses and take profits for the positions opened by this strategy. It has 6 options as follows:

- “Stop Loss (SL), %”: This is the stop loss in percentage of premium that a position would send a close order at if reached. This does not immediately close the position, only sending an order to close it to seek a better price for the legs.

- “Reentries after SL”: The number of times this position reenters immediately after closing by stop loss. Note that reentries use the original strategy parameters.

- “Market Stop Loss (MSL), %”: If a position incurs this percentage loss it is automatically closed as a market order as soon as it hits this percentage.

- “Reenter after MSL”: If ticked the position will be reentered after it hits the MSL target. Note that reentries use the original strategy parameters.

- “Take Profit (TP), %”: This is the profit percentage where the position tries to close at if reached. For example, a position that has reached 50% profit would send an order to close a position if the TP% is 50%.

- “Reentries after TP”: The number of times this position reenters immediately after closing by take profit. Note that reentries use the original strategy parameters.

- “Close if X days left to expiry and profit is less than Y%”: if a position opened by this strategy is less than a certain profit level and is nearing expiry this option can close the position to reduce the risk of it losing money. For example, if a position with a DTE of 14, X days of 4 and Y% profit of 50% Options Road will attempt to close it after 10 days of opening if it has only made 50% profit or less.

- “Maximum margin”: Maximum amount of margin that can be allocated to a position opened by this strategy.

- “No manual confirmation required”: If ticked Options Road will open new positions automatically. If unticked whenever a new position is about to be opened user input will be required to confirm the opening of this position. Opening or closing any position will require manual approval from the user. (Note that already opened positions will continue to be managed regardless.)

- “Single run”: If ticked then this strategy will run a single time then will not open new positions again after running once.

- “Create”: This button saves the strategy that was just created into the strategy list.

Running Strategies

Currently running strategies are shown on the right side of the tab and are ordered by the order added into trading from the strategy list. At the bottom of the list are 3 buttons as follows:- “Remove from Trading”: Removes the selected strategy from trading. Note that a strategy must have no open positions to be removed from trading, attempting to remove a strategy with open positions will not work.

- “Update strategy”: Updates the currently selected strategy both in running and strategies list with any changes made in the builder. For example, one might wish to change the delta of a leg, for that you need to select the strategy, edit the delta then click on this button.

- “Hold/continue strategy”: When pressed the currently selected strategy is put on hold and will not open new positions. If the strategy selected is already on hold pressing this again will remove the hold and allow new positions to be opened. (Note that already open positions will continue to be managed by Options Road automatically including stop loss and all close conditions)